Pharmaceutical sector is expanding day by day to occupy solutions for new medical conditions that arise. With an increase in the unmet medical needs, there will always be an increase in the release of drugs. The National Agency of Drug and Food Control (NADFC) also known as BPOM (Badan Pengawas Obat dan Makanan), the regulatory authority of Indonesia, has the responsibility of regulating Pharmaceuticals and related activities in Indonesia.

BPOM has introduced several regulations which must be complied with for the registration as well as the marketing of pharmaceuticals in Indonesia. This is because they prioritize consumer safety by assuring the availability of safe & quality medicines to the public. Continue reading to know about key regulations, process of registration, documents needed and more.

NADFC / BPOM Regulations for Pharmaceuticals in Indonesia

Some key pharmaceuticals regulations of NADFC/BPOM in Indonesia are listed below:

| Regulation Number | Year | Regulation on |

| 24 | 2017 | Criteria and Procedures for drug registration |

| 21 | 2015 | Procedure of clinical trial approvals |

| 72 | 1998 | Safeguarding of Pharmaceutical Preparations and medical devices |

| 1010 | 2008 | The registration of medicines |

| 1120 | 2008 | Amendment made to the above regulation. |

| 14 | 2019 | Recall and destruction of drugs |

| 34 | 2018 | GMP for drugs |

| 16 | 2015 | Procedures and assessments of new developed drugs |

| 17 | 2023 | Concerning Health services, pharmaceuticals included |

Need expert guidance on BPOM pharmaceutical regulations?

Explore our Pharma regulatory affairs services in Indonesia for compliant market entry.

NADFC/BPOM Requirement for Representative for Pharma Product Registration in Indonesia

In Indonesia, foreign pharmaceutical companies seeking to register their products must work with a local representative. The local representative will be the point of contact between NADFC/BPOM and the foreign company for all regulatory processes. The local representative must be

- An Indonesian-registered legal entity.

- They can be a Pharmaceutical company or Pharmaceutical wholesaler or a Local subsidiary or affiliate.

- Must possess the Drug Distribution License (SIK or Izin PBF) or Production License to manufacture pharmaceutical products in Indonesia

NADFC/BPOM Classification of Pharmaceuticals in Indonesia

There is a classification system for drugs in Indonesia which was initially based on Permenkes no: 917 in 1993, it was then later revised through Permenkes no: 949/2000. The classification is as follows:

- Free drugs (green circle label)

- Limited Free drug (blue circle label)

- Hard Drugs (red circle label)

- Psychotropic drugs and narcotics

The green and blue circle labelled drugs can be obtained in pharmacies without the need for a prescription.

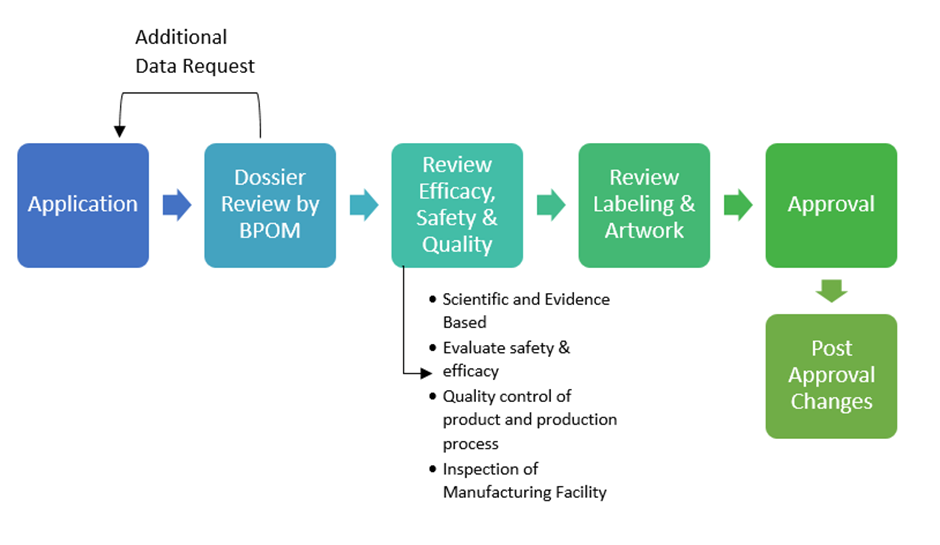

Drug Pharmaceutical Registration Process in Indonesia

Clinical Trials in Indonesia

Before marketing a new drug it has to undergo pre marketing clinical trials. To file for the approval of clinical trials of drug, a written format must be used by the sponsor or CRO to the Agency Chairperson. The form along with the process flow & documents required is given in the Annex 1 and Annex 2 of this document respectively.

What is Pre-registration Process Under NADFC/BPOM?

Pre-registration is the process that an applicant must undergo before registration to determine documents for registration, to know the registration category, path of evaluation along with the cost.

Registration is the process of registration and evaluation drugs to get a marketing permit.

Applications for pre-registration and registration can be submitted electronically.

Process flow of pre-registration of drugs

- The applicant must register an account with NADFC/BPOM following which the BPOM verifies and activates the account. Once this is done you can login and request for product ID.

- After the payment of fees and uploading the proof of payment and its verification (by BPOM), a notice of payment will be received via email.

- Fill the pre-registration form and submit the documents. The evaluation process begins, and the applicant can track the status of application.

- If it meets all the requirements, HPR (pre-registration result) approval.

Process flow for registration of drugs

- Applicant must fill out the registration form after choosing the drug to be registered from the HPR data.

- After the verification of the registration form, an SPB (order to pay) registration is issued. Upon making the payment, the proof of payment must be uploaded and once it is verified, the product ID is obtained.

- Now upload all the necessary registration documents. They are then evaluated. The application status can be tracked online. BPOM can either request for additional data or reject the application if the documents are not meeting the requirements.

- An approvable letter and NIE (marketing permit number) is granted if requirements are met.

NADFC/BPOM Registration Category for Pharma in Indonesia

There are mainly 3 types of registration. They are New registration, Variation registration and renewal registration. They are further divided into 7 categories.

New Registration

- Category 1 is for the registration of New drugs & biological products including biosimilar products.

- Category 2 is for the registration of generic drugs and branded generic drugs.

- Category 3 is for the registration of other preparations that contain special technology (transdermal patch, implants and beads).

Variation Registration: Any drug that has obtained marketing authorization and changes to that drug which can be in the form of safety, efficacy, quality, administration, product information or label must be reported to the Chairperson via this variation registration mechanism.

- Category 4 is for the major variation registration

- Category 5 is for minor variation registration

- Category 6 is for notification variation registration

Renewal of Registration

- Category 7 is the registration renewal

NADFC/BPOM Documentation and CTD Requirements for Pharmaceuticals in Indonesia

Registration documents are submitted and prepared in the ACTD format. The documents consists of

- Part I: Administrative documents, product information and labels

- Part II: Quality Documents

- Part III: Non-clinical documents

- Part IV: Clinical documents

- Annex IV, V, VI, VII, VIII, IX & X of the BPOM regulation (no: 24, 2017) explains about the documents to be contained in each part.

Dossier Submission Requirements for Different Drug Types

New Drugs (Innovative Drugs): Full CTD dossier including detailed clinical trial data

- Stability Data: Long-term, accelerated, and in-use stability studies are needed.

- Clinical Data: Includes local clinical trials if necessary, or foreign clinical trial data with relevance to the Indonesian population.

Generic Drugs: The dossier submission follows the abbreviated format of the CTD.

- Bioequivalence Study: Demonstrating therapeutic equivalence to the reference innovator drug (required under Module 5).

- Module 4: Non-clinical studies may not be required for generics.

- Stability Data: Stability testing for the generic formulation.

Biological Products: Products such as vaccines, monoclonal antibodies, blood products require more extensive data due to the complexity of their production.

- Module 3 : (Quality) is significantly expanded for biologics to cover the detailed production process of biological materials.

- Immunogenicity Studies: Specific immunogenicity testing is required to evaluate safety.

Traditional Medicines and Herbal Products: Traditional and herbal products follow a simplified registration process.

- Module 3 is the most critical, focusing on quality and safety of the ingredients, manufacturing processes, and GMP compliance.

- Clinical and non-clinical data may not be required, especially for products with a well-documented history of safe use.

Additional Dossier Requirements for Imported Drugs

For imported drugs, additional documents must be submitted along with the CTD dossier:

- Certificate of Pharmaceutical Product (CPP) from the country of origin.

- Good Manufacturing Practice (GMP) Certificate of the manufacturing facility.

- Import License: Issued by BPOM or the relevant authority.

- Letter of Authorisation for Local Representative

Dossier Submission Format for Pharmaceuticals in Indonesia

The documents must be submitted in Indonesian or in English language. It can be submitted electronically but manual submission is also accepted in any event the electronic registration cannot be submitted or if the electronic system does not work.

NADFC/BPOM Labeling Requirements for Pharmaceuticals in Indonesia

All information on the label must be written in Bahasa Indonesia. For imported drugs, a certified translation must be provided. The following information is mandatory for inclusion on all drug labels:

- Product Name

- Composition

- Dosage Form and Strength

- Indications and Uses

- Dosage and Administration

- Contraindications

- Warnings and Precautions

- Adverse Reactions

- Storage Conditions

- Expiry Date and Lot Number

- Registration Number

- Manufacturer Information

- Authorization by BPOM

- Special Symbols and Identification

NADFC/BPOM Classification Labels for Pharmaceuticals in Indonesia

- Green Circle: Over-the-counter (OTC) or free drugs (Obat Bebas).

- Blue Circle: Limited over-the-counter drugs (Obat Bebas Terbatas) with usage restrictions.

- Red Circle with “K”: Prescription drugs (Obat Keras).

- Red Circle with “N”: Narcotic drugs (Obat Narkotika).

- Special Symbols: Additional labeling for psychotropic drugs, traditional medicines, biological products, and generic drugs.

NADFC/BPOM Registration Fees for Pharmaceuticals in Indonesia

The NAFDC fees vary depending on the drug category and the pathway. Generally, the fees for imported drugs are comparable to those for locally manufactured products.

| Registration category | Registration Fees (IDR/USD) |

| New Drug | 10 million to 20 million (USD 650–1,300) |

| Generic Drug | 8 million to 15 million (USD 520–1,000) |

| Traditional Medicines and Herbal Products | 2 million to 5 million (USD 130–325) |

| Biologics and Biosimilars | 15 million to 30 million (USD 975–1,950). |

| Fast-Track or Expedited Registration | 10 million to 25 million (USD 650–1,625) |

| Minor Variantions / Amendments | 1 million to 3 million (USD 65–195) |

| Major Variantions / Amendments | 5 million to 10 million (USD 325–650) |

** Please note that the fees provided are subjected to change. So, it is advised to refer NADFC/BPOM official website prior to making any payment**

NADFC/BPOM Timelines for the approval of Pharmaceuticals in Indonesia

| Description | Timeline |

| For new chemical entities, biologics, or innovative drugs. | Up to 300 WD |

| For generic drugs requiring bioequivalence data. | Up to 150 WD |

| For priority drugs (orphan, pandemic, public health). | Less than 150 WD |

| For traditional medicines and herbal products. | Up to 100 WD |

| For urgent products (e.g., COVID-19 vaccines, treatments). | <100 WD |

| For foreign products with a local representative. | Varies |

| For minor variations | 40 WD |

| For Major variations | 100-300 WD (Depends on the category and variations) |

| Registration Renewal | 10 WD |

WD: Working days

Requirements for Imported Drugs in Indonesia

Who Can Apply?

Domestic Manufacturers in Indonesia can apply for Drug Import Application based on authorization from Foreign Manufacturers.

Manufacturer Criteria:

Domestic Manufacturer must have a valid GMP license with last date of inspection within last 2 years.

Site Master File (SMF) in case if the manufacturer does not have same dosage form authorized to be marketed in Indonesia OR if there is a change in production facility for marketed same dosage form

- Site Inspection can be conducted if SMF requires evidence of GMP compliance

- Online Submission and Licensing System in Indonesia

- Online Single Submission Service (OSS)

- Validity of the NADFC/BPOM Approvals for Pharmaceuticals in Indonesia

The marketing authorization of a pharmaceutical approved by NAFDC /BPOM is valid for five years from the date of issuance.

Validity of the NADFC/BPOM Approvals for Pharmaceuticals in Indonesia

The marketing authorization of a pharmaceutical approved by NAFDC /BPOM is valid for five years from the date of issuance.

Renewal of Pharmaceuticals Marketing Authorizations in Indonesia

Before the five-year period ends, companies must submit a renewal application to BPOM to extend the marketing authorization. It must not be submitted prior to 12 months and after 2 months of the date of expiry of the marketing authorization.

NADFC/BPOM Post Marketing Surveillance (PMS) Requirements for Pharmaceuticals in Indonesia

The drug is always under evaluation. It is not that if a drug has gained its approval to get into market then it is an all time success. The drug is always under surveillance which is called post marketing surveillance (PMS). This is essential for monitoring and maintaining the safety, efficacy and quality of the pharmaceuticals released into the market.

Timely submission of periodic safety update reports (PSURs) is one of the major parts in the PMS system. The pharmaceutical company must submit a periodic safety update report which includes cumulative safety related information of the drug in the market.

The period of submission varies slightly for each country. In general, the timeline to submit is every 6 months for 2 years and then annually. It is not required to submit if there are no safety issues or updates for some countries but for others reports must be submitted until for a period of time stated by the regulatory.

Healthcare professionals and other stakeholders are always encouraged to report ADR to the pharmaceutical company or through BPOM Indonesia official website. Companies must always analyse for any potential signals or patterns that may arise. It is always important and beneficial to formulate a quality assurance as well as a risk management plan. This will give us evidence and confidence that the drug is under control and is of quality.

BPOM can recall pharmaceuticals from markets that are not up to the standards. So, maintaining a standard product even after approval is essential. Regular audits, risk mitigation and preventive actions must be included in the PMS.

Conclusion

The NADFC/BPOM pharmaceutical regulations in Indonesia are set forth to strengthen the regulation of pharmaceuticals in Indonesia. To produce and market a product it needs to comply with a number of regulations and other strict requirements. A major challenge in Indonesia is the lack of translation of regulatory guidelines provided for us to comply with.

Although this is not a major issue for local pharmaceutical developers, it is frustrating for foreign manufacturers & importers. However, compliance with these regulations leave no space for substandard products and provide assurance for reach of safe medicines to consumers.

Artixio, with years of experience can guide you through the NADFC/BPOM regulations for pharmaceuticals. Our regional regulatory experts in Indonesia provide on point strategic solutions, find expedited processes eligible and assist you with comprehensive services required for approval of pharmaceuticals. Connect with us through info@artixio.com

FAQ’s

Q. How are ADR reported in Indonesia?

A. In Indonesia, the healthcare professionals can report adverse drug reactions in a form to the National Agency of Drug and Food Control (NADFC) as a voluntary report. The form for reporting ADR in Indonesia is called the Yellow Form.

Q. Which CTD format is followed in Indonesia?

A. The CTD format followed in Indonesia is the ACTD, The ASEAN Common Technical Dossier format.

Q. Within how many days should the applicant provide additional data if requested by BPOM?

A. The applicant must provide additional data within 100 days from the date of request of additional data.

Q. What is a circulation permit and are there any exemptions?

A. In Indonesia, before a drug can be circulated in its territory prior registration must be done to get a circulation permit. Yes, some medicines are exempted from the circulation permit. They are donation medicines, medicines for a specific use at doctor’s request, medicines for clinical examinations and sample medicines for registration.